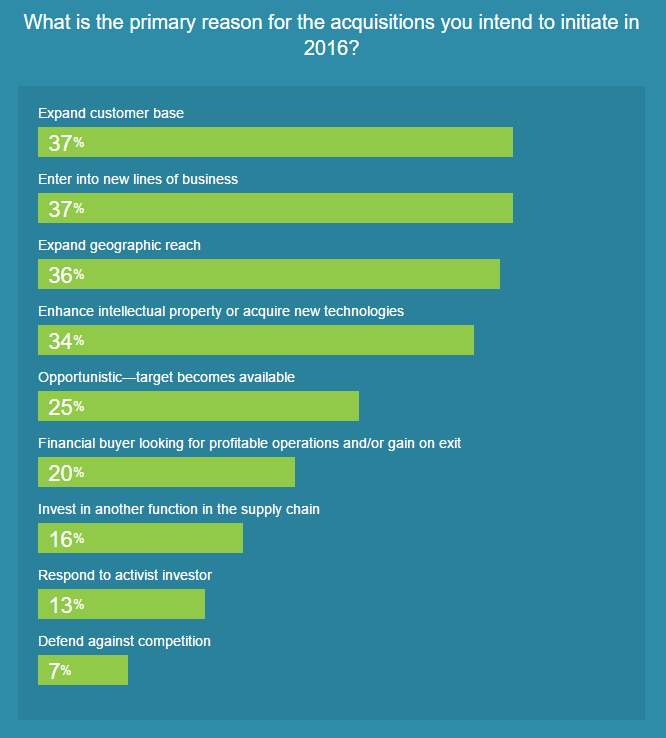

When 500 US CEOs were surveyed, these were the primary motivations named for an acquisition.

We will likely hear a lot about corporate deals, mergers and acquisitions in 2016. Partly because it’s an election year and Wall Street is a hot topic. But mainly because, experts are calling for a robust year of deal making thanks to low interest rates and an abundance of cash in and around the marketplace. So… what about small to medium-sized businesses? Does this “grow by acquisition” strategy make sense for them too?

At my weekly BNI meetings, I’m often explaining why it makes sense for a any profitable, expanding business to grow by acquisition. Certainly, there are economies of scale and those are so much more than greater purchasing power or using the same accountant! Just as I was creating my own list, Greg Kells published his, under the title of Fiscal Fitness. Great minds think alike; I thought I’d share.

Here’s where many of the savings come from:-

ACCESS

- Clients

- Intellectual Property

- Specialized Skills

- Distribution Channels

Existing Departments:

(with rare incremental costs)

- Accounting

- Admin

- Rent

Increased Use of

- Production Facilities

- The Sales Force

- Purchasing Power – this last one can be HUGE!!!

Reduction In

- Marketing and Sales Costs

- Risk – if you diversify across the new acquisition

- Travel Costs

- Transportation Costs

When you can fold in another company to one you’re already running, (running well and with good margins) it is only natural to see a greater use of current resources without raising costs, even incrementally.

-

Additional Products to Sell To Existing Customers

-

Growth to increase appeal to Private Equity Groups

-

Increased multiple on company sale based upon higher revenue

Greater control of supply channel

Eliminate competition to increase margin and market share

Enhanced market position or reputation

To satisfy clients’ need without risking exposure to competitors

Mergers & Acquisitions in 2016- the Big Picture

When you buy a competitor…Greg writes…

These [complementary acquisitions] deals often generate high margins due to synergies that allow the buyer to add on the revenue of the acquisition without the costs the seller (and their smaller business) had.

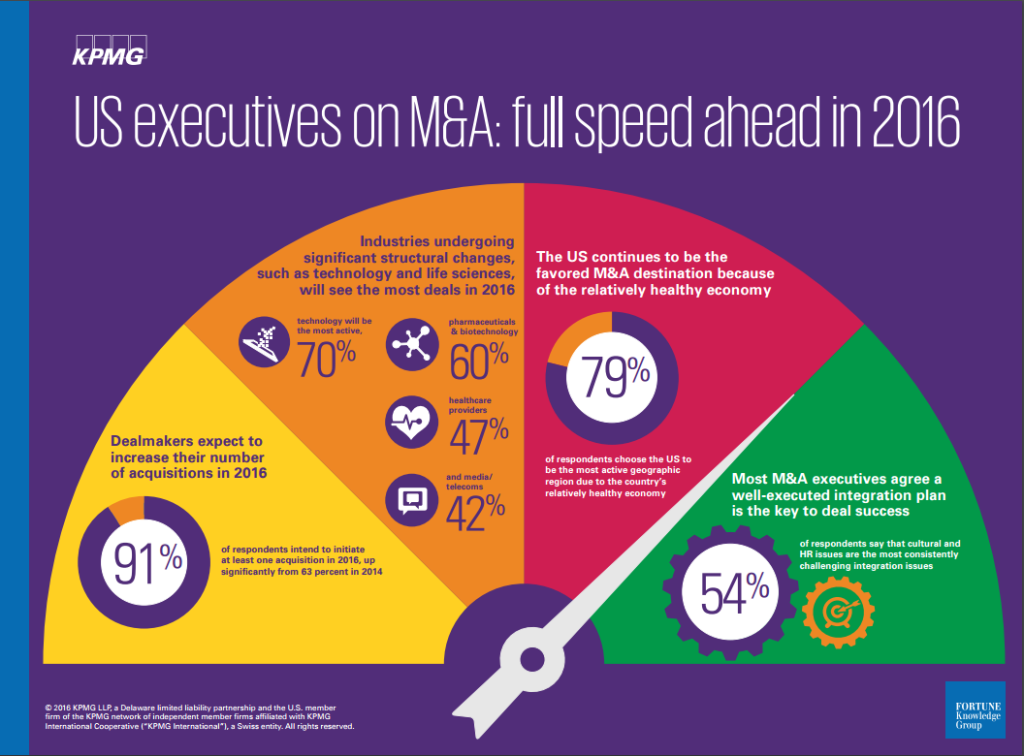

KPMG expects acquisition momentum to continue through 2016. Surveying 550 executives, KMPG identifed

- low interest rates,

- resilient stock prices,

- solid employment numbers and

- an abundance of cash

as the key motivators for deal makers this year. Here is their big picture, literally!

37% of those surveyed said they grow by acquisition to expand their customer base (see the graphic above). When you consider the cost of acquiring a new customer, and how impervious the consumer is to advertising, perhaps the cheapest, and certainly the least risky way to grow is by merging with an existing company. It makes so much sense you can add on, or fold in, to what you’re already doing successfully.

If you would like to discuss an acquisition with me, I can be reached at 904-647-4755 or shoot me an email.